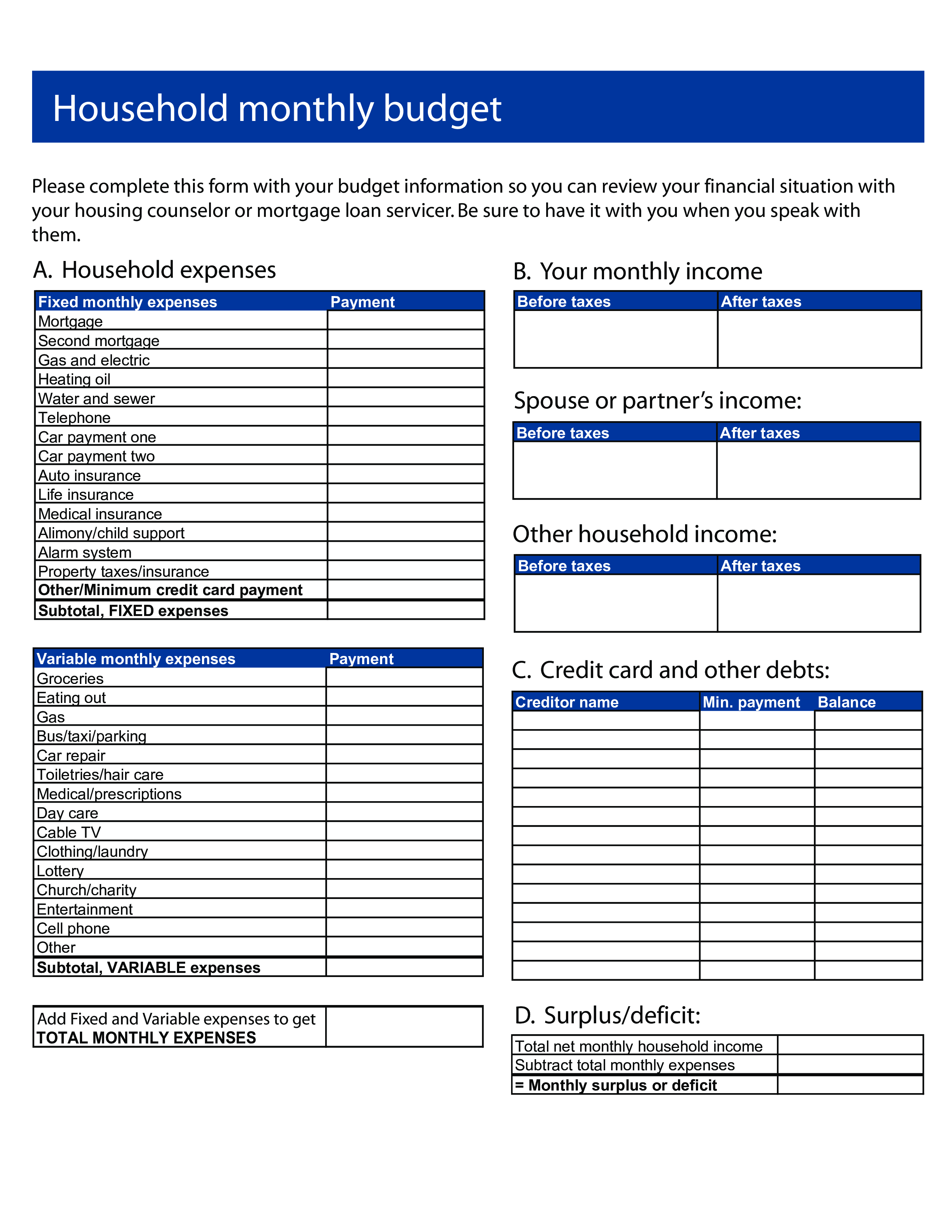

You may have to account for interest expenses on unpaid balances.

#Monthly expenses list sample how to#

How to Handle Periodic or Temporary Income Likewise, if you include a medical expense but not its reimbursement, you will overstate your expenses. Take note! If you include a medical reimbursement in the “Income” form and not the actual expense in the “Expense” form, you will overstate your income. Even though the reimbursements cancel out the actual expenses, including them in your spending plan will help you keep track of how you spend your money. This is why any medical reimbursement amounts and the actual expense amounts must both appear in your spending plan.

Reimbursements are not a source of income, but a type of payment for medical care. You may receive reimbursements for some medical costs from your health care provider. Also list all the income or funding you can reasonably expect to receive related to your child’s disability, such as government health care assistance and gifts of money from community, civic, or religious organizations. Using your organized documents and the “Income” form (see links below), enter the amounts of your current monthly income in the first column. Over time, your financial needs may change, health care costs will likely change as your child’s needs change, or your financial situation may change significantly from a loss of income, a job, or a benefit. To get started, just fill out Column 1, “Current Amount.” But you’ll want to come back and fill in the “Anticipated Amount” column. “Anticipated Amount” refers to income and expense amounts you think you might have in the near future. “Current Amount” refers to the income and expense amounts you have today. The spending plan forms for Steps 1, 2, and 3 have two columns: How to Use the Spending Plan Forms for Steps 1, 2 & 3 Read, understand, and keep handy these two documents:

National Parent Center on Transition & Employment.Goldberg Champion for Children with Disabilities Award

0 kommentar(er)

0 kommentar(er)